- UK fintech AGAM International’s finance platform enables Prime Bank employees to benefit from first-of-its-kind Bank-led Earned Wage Access

- AGAM International is embedding innovation into Bangladesh’s financial services with ‘inclusive by design’ AI-technology that enables banks to rapidly and accurately assess the credit worthiness of customers

- Wider commercial roll out in 2023, with call for corporates to follow suit

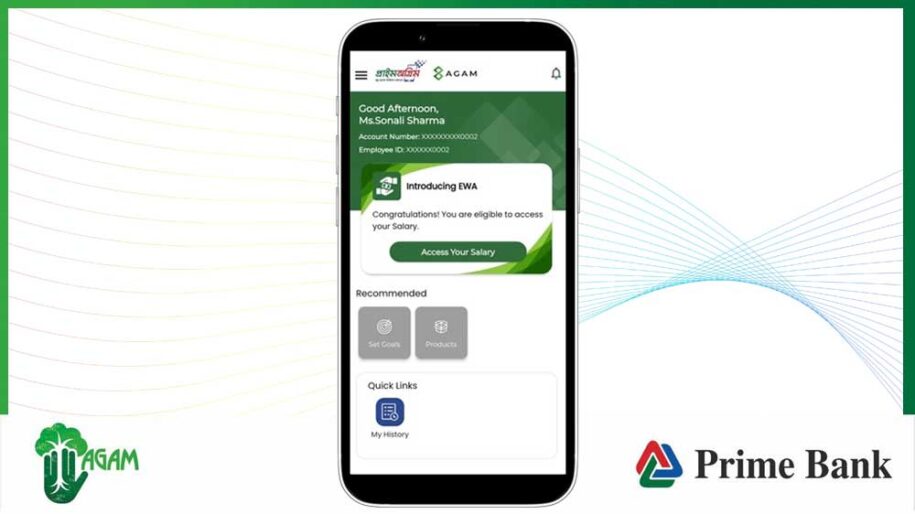

Cardiff, Dhaka, Monday 27th February 2023 – UK fintech AGAM International is pioneering an early salary access pilot with leading Bangladesh bank, Prime Bank. The pilot will allow instant access to earned wages for thousands of Prime Bank employees.

It is the first bank-powered Earned Wage Access in Bangladesh. This development will allow thousands of Prime Bank employees to access their wages prior to pay day, improving their financial stability and limiting the need to borrow loans through informal lenders.

It is the latest development of next generation fintech to come out of AGAM International’s partnership with Prime Bank. This follows the commercial roll out of a bank-backed micro-loan scheme for individuals last year, which paved the way for millions of Bangladeshis to potentially access credit.

The new Earned Wage Pilot is part of a suite of products that form AGAM International’s finance platform, which is designed for growth markets and revolutionising the way customers interact with financial institutions.

Following the pilot, AGAM International and Prime Bank intend to roll out the Earned Wage Access scheme to major Bangladesh corporates – who are invited to express their interest. Prime Bank intends to provide this transformational service to all their payroll account holders, enabling them to withdraw part of their salary at any time in the month without the need to wait for the payday.

The pilot follows the December 2022 launch of PrimeAgrim, a digital nano-loan scheme between Prime Bank and AGAM International which is revolutionising lending to individuals that are underserved. PrimeAgrim is also transforming the concept of financial literacy and financial inclusion in Bangladesh by embedding education through service and products.

Founded in 2019, AGAM International, which means ‘advance’ in Bangla, and which is backed by the Development Bank of Wales, has a mission to enhance both lives and livelihoods of banking customers by providing the infrastructure for leading banks in growth markets to deploy innovative solutions to ensure better service for their customers – including Gen Z, who demand a new way of banking. AGAM International has developed a series of fintech innovations which are set to reshape the banking landscape in growth economies with its scalable model.

Speaking about the pilot, AGAM International’s founder and CEO, Shabnam Wazed, said: “Earned Wage Access not only allows instant access to funds but allows the ability to pay for unexpected expenses, empowering individuals to manage their income on their own terms. I am excited to see the pilot unfold at Prime Bank and look forward to rolling out AGAM International’s technology to benefit employees of other businesses, powered by Prime Bank.”

Senior Official from Prime Bank commented on the pilot: “We partnered with AGAM International to maximise the power of AI and technology to ensure our services can access the best services equipped with the technological advances of the recent fintech revolution. Piloting the Earned Wage Access with our employees underscores our confidence in innovation powered by AGAM International and we are excited to see the results.”

About AGAM International:

AGAM International enables financial institutions in growth markets to accelerate the digitalisation of products and services to their customers through its Banking-as-a-Service platform.

AGAM, which means advance in Bangla, puts financial empowerment and responsibility directly in the hands of individuals and businesses. Its platform is powered by its dynamic AI credit scoring algorithm, enabling lending to a broader community. Customers are supported in their financial journey with AGAM International’s digital mentoring app to become more bankable, improving both financial literacy and credit scores. The company’s scalable neo banking model provides transparent, dynamic, de-risked credit decisions for financial institutions.

This all supports AGAM International’s wider mission to make banking and finance available to all, advancing lives and livelihoods.

Founded by female CEO, Shabnam Wazed, AGAM International is head quartered in Cardiff, UK, and operational in Bangladesh, with plans to scale into other growth markets. Wazed is supported by a senior management team including: Chair, Nish Kotecha, an entrepreneur, banking and board professional; and, Chief Technology Officer, Rohit Sankhe. The management have a combined experience of over 40 years. The company closed its latest funding round in November 2022, with international investors led by the Development Bank of Wales. AGAM International has also been backed via the UK Department for International Trade’s Global Entrepreneur programme, Invest UK and the FinTech Wales Foundry Accelerator programme.

AGAM International was the joint winner of the Global Fintech DIT (UK) Award, 2021 and Shabnam Wazed won Computing’s Women in Tech Excellence Award 2022.

About Prime Bank: Prime Bank Limited, is a top-tier second generation commercial bank in Bangladesh. Prime Bank is best known for its expertise in Corporate and Institutional Banking and its innovative Digital Banking services. Global Finance, a North America based leading financial publication has recognized Prime Bank as the Best Bank in Bangladesh in 2020. Prime Bank has been also recently recognized at the prestigious Efma-Accenture Banking Innovation Awards 2021 under Analytics & Artificial Intelligence (AI) category for one of its digital initiatives. Prime Bank has been creating positive asset impact through its investments and financing strategies, its focus on financial inclusion, and its drive to harvest product innovations and digitize processes to aid the country’s irrepressible growth.

Leave a Reply